Monitoring of the

Cryptocurrency Transaction Graph

Everybody is talking about cryptocurrencies. But how are they actually circulating?

Motivation

In recent years, cryptocurrencies made their way into the mainstream. Their decentralized ungoverned nature made them attractive to people that were unsatisfied with the current financial system. Their extreme growth of value made them attractive to investors. Their volatility made them attractive to speculators. Their anonymity made them attractive to criminals.

How anonymous and decentralized the most prominent cryptocurrency bitcoin really is, was being researched resulting in surprising results. You can read more about it in the Section Further Research down below.

In this project, I focused on the most prominent cryptocurrency Bitcoin. From the beginning, each transaction between users is recorded and saved in the blockchain in such a way that it is publicly visible. If interested in a transaction or specific wallet, users can navigate through blockchain explorer websites like SoChain .

I inspected part of the Bitcoin transaction graph because I was interested in the following questions:

- How do bitcoin users act in the network? Do they hold their coins as an investment or do they frequently transact with other users?

- Can we predict changes in the currency's value and volatility using the analysis of previous transactions?

- Can we spot cycles in the network that could lead to either stable business transactions or illegal activities like wash-trading and money laundering?

Approach

As already mentioned, there are freely available block site explorers on the internet. Interested in a specific transaction or wallet, they are convenient and easy to navigate. Since we are not interested in individuals but in computing metrics on large portions of the transaction graph, we have to build our own solution.

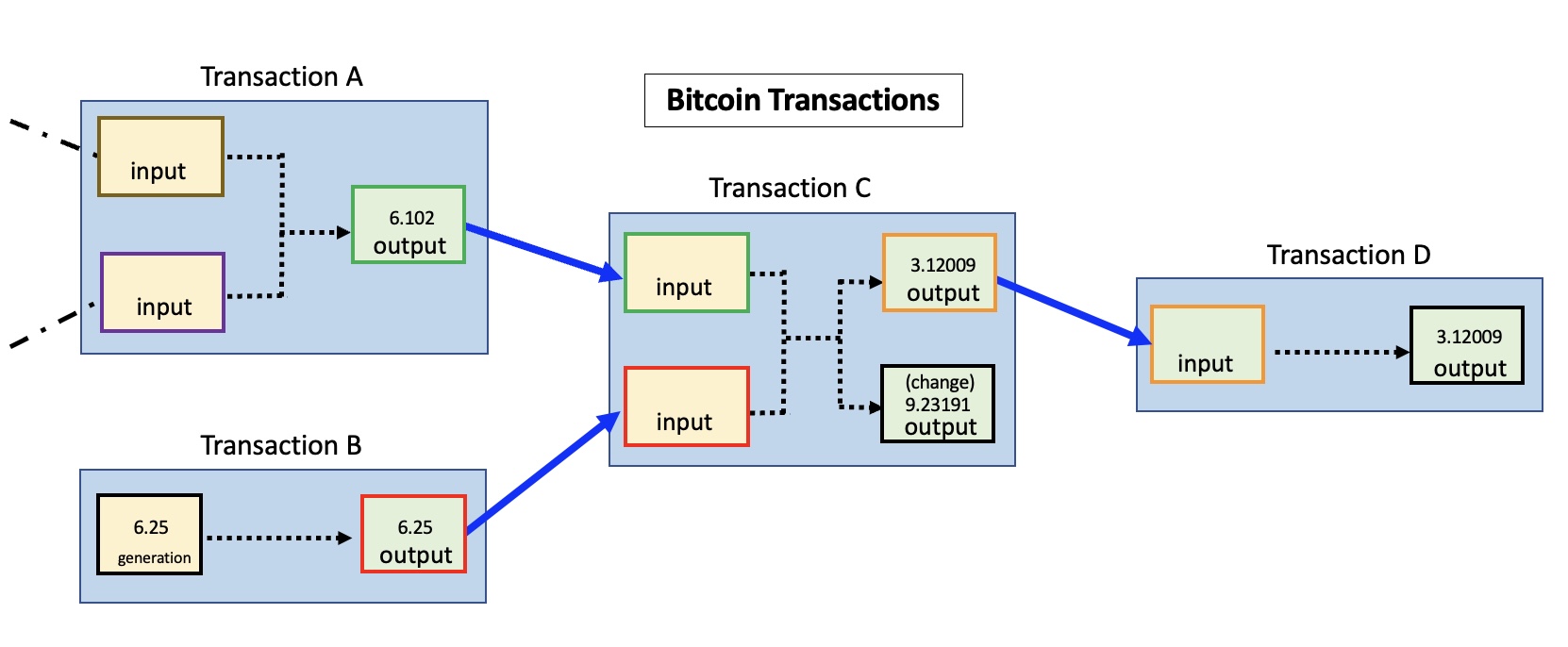

A transaction in the blockchain

Transactions are recorded in the blockchain. To be memory efficient there is no redundant information in the data. There are several important aspects of how transactions are encoded:

- Transactions are not just between two users. A transaction can contain multiple inputs and multiple outputs.

- The only way to split packages of coins is through transactions. You can only send the exact amount of coins you received in a previous transaction. If it is however more than you want to send, you will receive change.

- Based on the previous point, the outputs of a transaction directly correspond to inputs of previous transactions. Since their amount is the same, only output values are recorded and the value of inputs can be inferred through references to previous transactions.

- Every transaction has a small fee. This fee goes directly to the miner that verified the block the transaction is part of.

While these are the most important points, completely understanding the system in which transactions are recorded can take some time. Luckily, there is this great site that goes more into detail about those encodings.

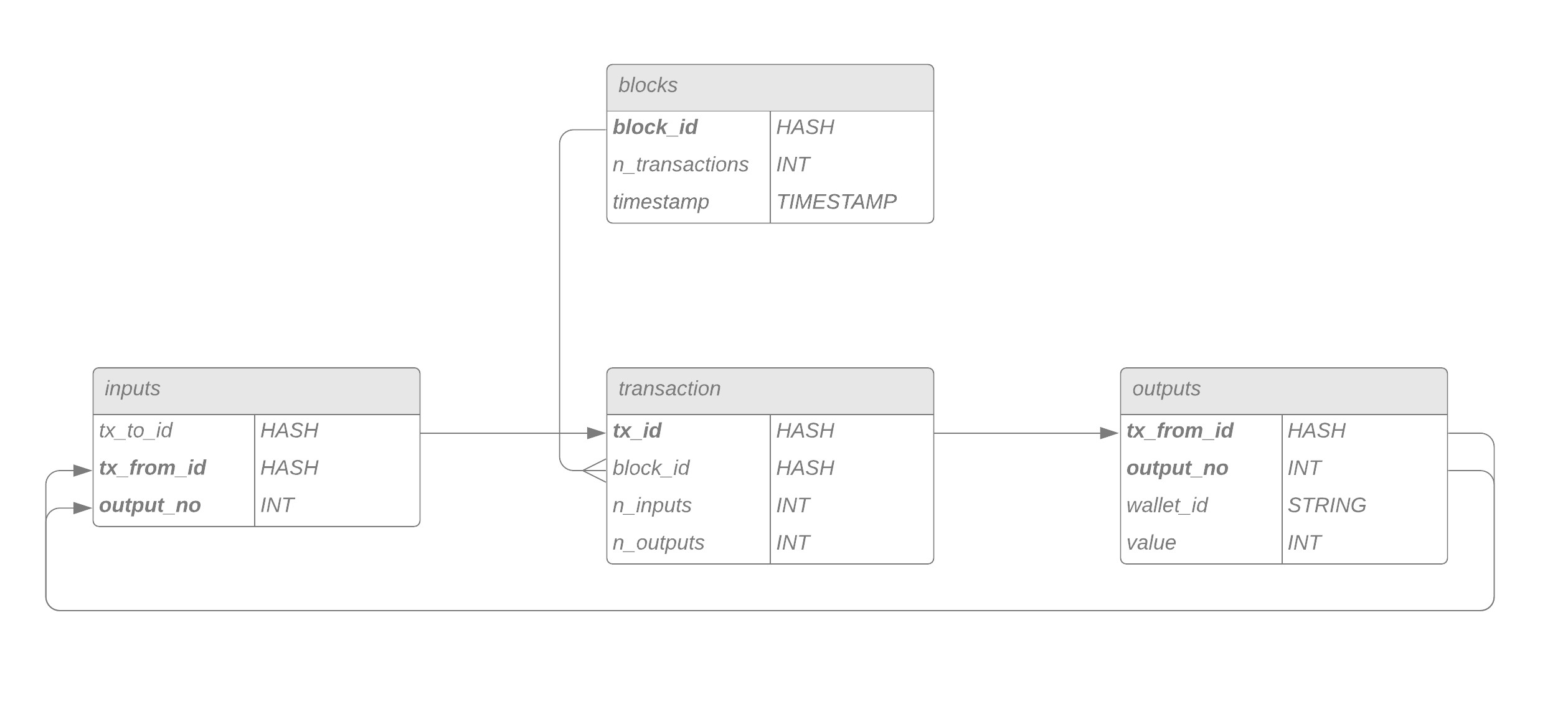

A transaction database

To evaluate the transactions in the blockchain, we have to read them and have a way to quickly navigate and aggregate them. My approach was to build a relational database for transactions and wallets using MySQL.

Data

Since the size of the blockchain is exponentially rising with time, with the resources given in this project it was not feasible to read in the complete blockchain. Instead, the analysis was conducted on a subset of the data.

- Transactions in the timeframe: 9th August 2021 - 2nd October 2021

- 8000 blocks

- 13 million transactions

- 40 million inputs, 40 million outputs

- 84% of the inputs originate from outputs in the same period

Results

Disclaimer: Under the current circumstances some of the results are biased. The transaction values are the sum of their outputs and therefore do not consider which proportion of them is the change that goes back to the sender. See the next section for a discussion on this problem!

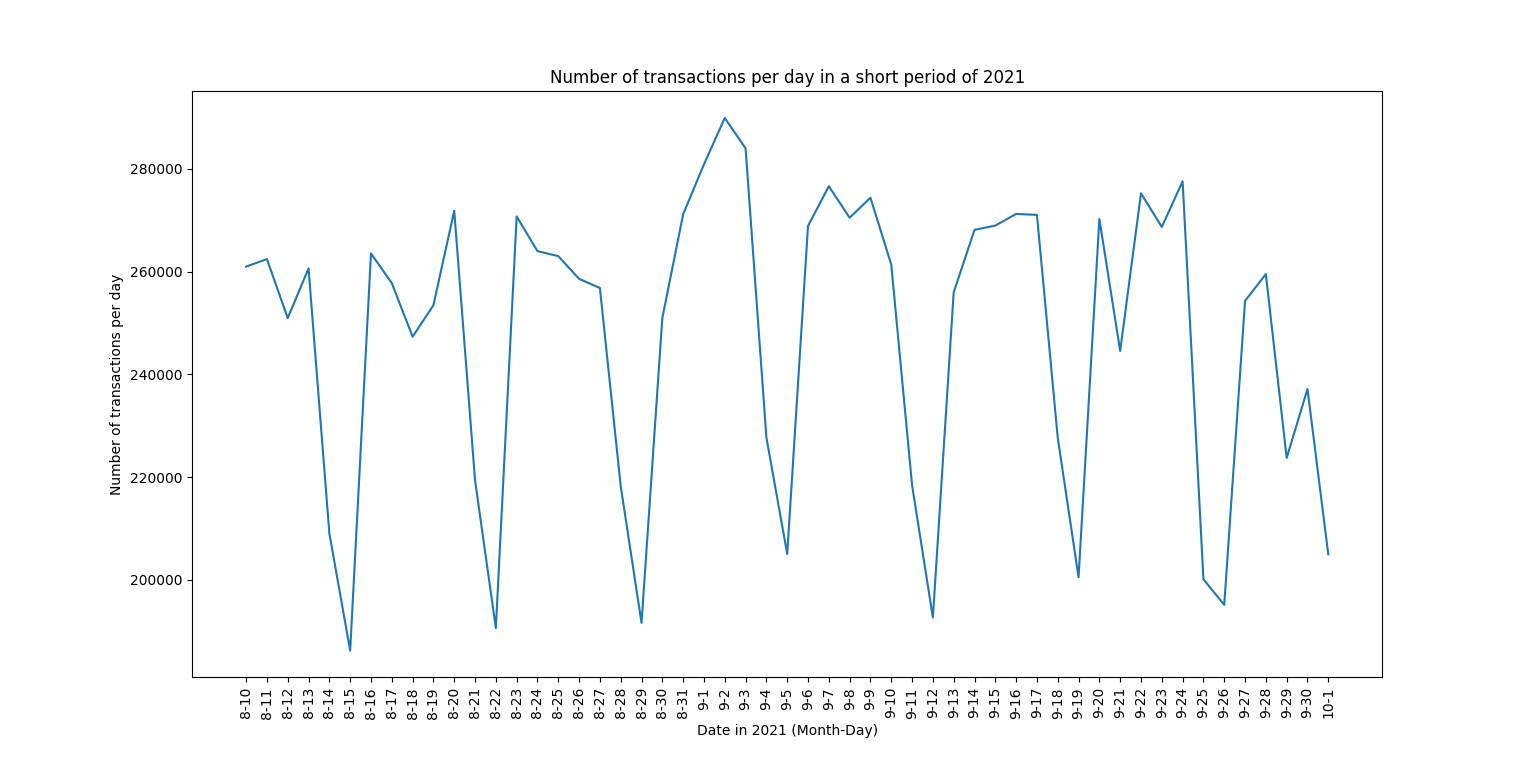

Daily transactions

First, we will investigate transactions per day.

We can clearly see a periodic pattern in the number of daily transactions. Can you guess what the low points in the graph have in common? They occur on Sundays. One way to interpret this is that the difference between peaks and low points originates from the difference between private traders and professional actors in the network that take a time off on Sundays. While there can also be other explanations for this large gap, this is an interesting clue for how the currency is used in practice.

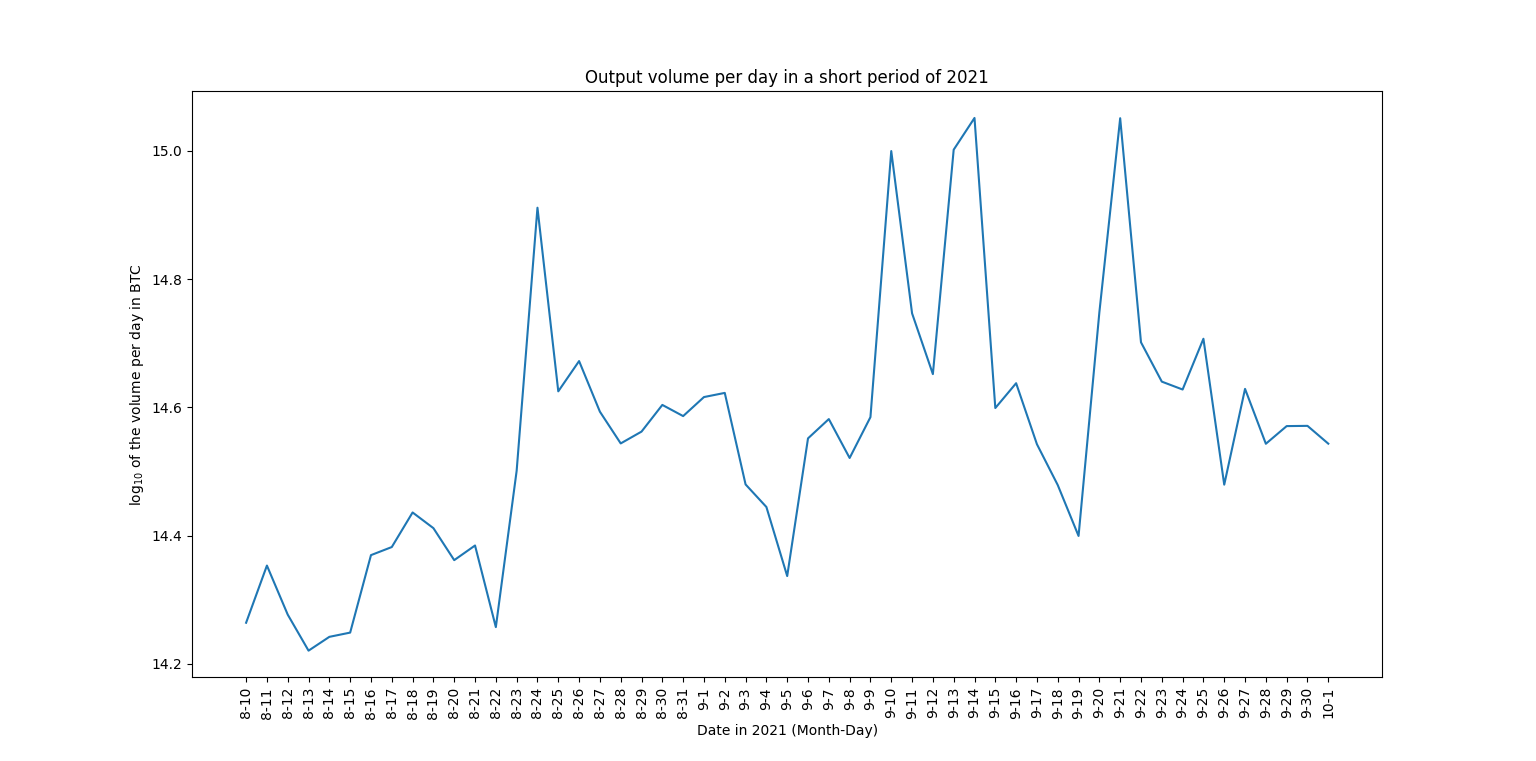

We can also observe strong daily variability in the sum of transaction outputs.

Average holding time

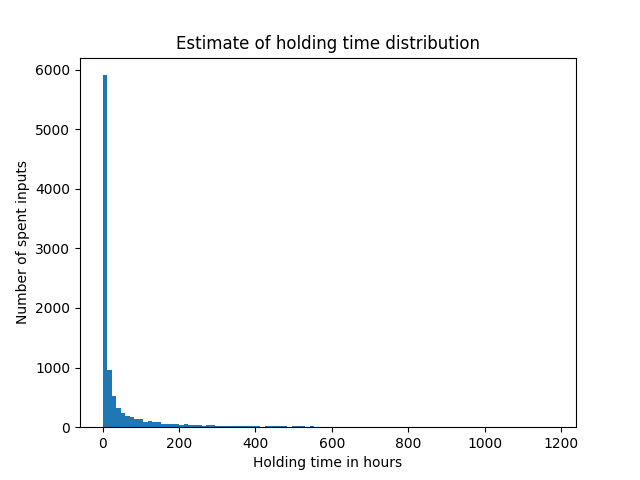

Another interesting question is: How long do people hold Bitcoin? Do they use it for long-term investments? Do they use it as a currency for business transactions? Do they perform high-frequency trading?

We can observe that the vast majority of Bitcoins get transferred again just hours after their receiving. This hints at either high-frequency trading or illegal activities like money laundering or wash trading.

Daily distribution of transaction volumes

In the plot below, we can observe the distributions of transaction volumes in BTC animated such that each frame represents one day in September 2021.

These distributions can tell us, in what volumes Bitcoins are traded on average. We can observe differences in distributions but also spikes at the same places. This hints at similar trading activities by either the same or different agents. We can also see constant output values around 104=1000 BTC. Keep in mind that with the average BTC price in this timeframe of about 45,000$, this means that those transactions transferred more than 45,000,000 dollars.

Difficulties and outlook

Data volume and resource intensity

Bitcoin's blockchain is growing exponentially and was approaching 400GB in compressed form at the time of the project. To load this amount of data into a relational database and then calculate computationally expensive metrics on it was not possible with the given resources.

Reading out blocks from raw files was done using Python and should optimally be implemented in a programming language that is designed for heavy computations. Also, the chosen database might not be optimal for this task. Given the structure of our data, a graph database like Neo4j would be an obvious choice.

Problems with using only a subset of the data

You might say: No problem, I am only interested in a specific time interval anyways. It turns out that there is still a problem with this approach. As discussed in the explanation above, the transaction recordings build upon each other. This means that you only have the complete information about one transaction if you already read in all previous transactions that are directly connected to it.

Otherwise, you know everything about the transaction's outputs but not about it the wallet IDs and the amount of its inputs. Since we used a limited timeframe, for some transactions inputs are unknown and it is not possible to infer how much of the transferred currency is just the change that goes back to the sender.

Additionally, it introduces a selection bias to holding time estimation. Given a timeframe of n days, we can't record coin holding times greater than n days.

Cycles and individuals with multiple wallets

One point of interest was also the detection of cycles in the network. This is especially interesting for Financial Forensics. The main problem with such investigations is that it is very easy to create a large number of Bitcoin wallets. Individuals can own a network compromising thousands of wallets and purposely circulate their money in such a way that it is hard to retrace the paths it has taken.

Detecting such behavior is extremely difficult in a network of this size. Therefore it is said that in cryptocurrency networks criminals are hiding in plain sight.

Real-time monitoring using a dashboard

The long-term outlook for the project is a dashboard for real-time monitoring of transactions. This dashboard should display statistics about transactions and should alert the user when anomalies in the transaction network occur. This can be useful for trading strategies or to warn the user of potential crashes of the currency, as we have seen in the past.

Further readings

- Roberts, S. (2022, June 7). How 'trustless' is bitcoin, really? The New York Times. Retrieved August 8, 2022, from https://www.nytimes.com/2022/06/06/science/bitcoin-nakamoto-blackburn-crypto.html

- Blackburn, A., Huber, C., Eliaz, Y., Shamim, M. S., Weisz, D., Seshadri, G., ... & Aiden, E. L. (2022). Cooperation among an anonymous group protected Bitcoin during failures of decentralization. arXiv preprint arXiv:2206.02871.

- Meiklejohn, S., Pomarole, M., Jordan, G., Levchenko, K., McCoy, D., Voelker, G. M., & Savage, S. (2013, October). A fistful of bitcoins: characterizing payments among men with no names. In Proceedings of the 2013 conference on Internet measurement conference (pp. 127-140).